- Become a Lawyer

- Become a Principal

- Visiting Lawyers

- Membership Services

- How to Become a Member in Alberta

- Billing Cycles, Filing Deadlines and Other Key Dates

- Status Options & Contact Information Changes

- Making a Payment to the Law Society

- Membership & Indemnity Program Renewals

- Member & Indemnity Certificates

- Indemnity & Indemnity Exemptions

- Professional Corporations (PCs)

- Limited Liability Partnerships (LLPs)

- Complaints

- Alberta Lawyers Indemnity Association (ALIA)

- Western Canada Competency Profile

- Continuing Professional Development

- Practice Advisors

- Trust Accounting & Safety

- Practice Management Consultations

- Equity Ombudsperson

- Fraud & Loss Prevention

- Approved Legal Services Providers

- Forms & Certificates

- Home

- Lawyers & Students

- Trust Accounting & Safety

The Law Society of Alberta regulates the legal profession in the public interest. In alignment with the Law Society’s vision, mission and strategic plan, the Trust Safety department provides a program that endeavours to protect the public and ensure the safety of trust property. This program ensures that lawyers are complying with the standards set in the Financial Rules of the Law Society of Alberta regarding Trust Safety, educates lawyers about their responsibilities with respect to trust property, requires financial reporting from lawyers and audits their financial records.

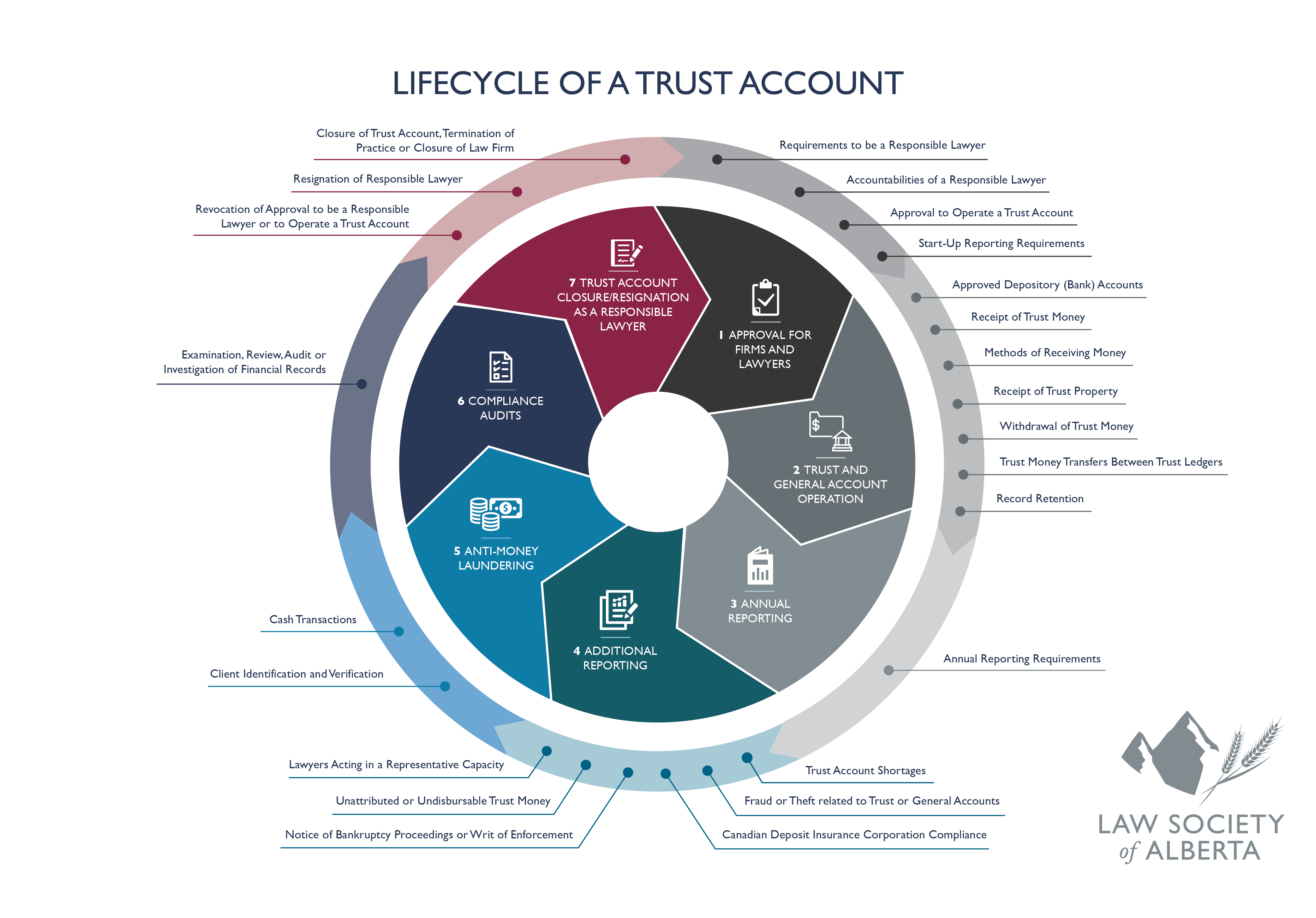

Lifecycle of a Trust Account

On Jan. 1, 2022, the Law Society instituted amended Rules regarding the approval and management of trust accounts by Alberta lawyers. The Rules have been realigned to better suit the lifecycle of a trust account and incorporate modern practices and technologies used by law firms in Alberta.

For more information on the changes, read the full announcement.

To cross-reference the new Rules to the prior Rule versions, please review this chart.

To find out more information on how to become a Responsible Lawyer and operate a trust account, please visit our Approvals and Account Operations pages.

Service Standards

We commit to the following service standards in providing you with the help you need:

| Service | Timeline |

|---|---|

| Application to Designate a Responsible Lawyer and/or Operate a Trust Account | Three to four weeks from the time the Certificates of Completion for the Trust Safety Online Modules are received. The processing time may be extended depending on the amount of follow up required in the process and volume of applications. |

| Application for Exemption | Three to four weeks from the time the Application is received. The processing time may be extended depending on the amount of follow up required in the process and volume of applications. |

| Designate an Alternate Signing Authority | Two weeks for new requests and renewals. |

| General enquiries – telephone service level | Two to four hours |

| Email enquiries | Two to four hours |

*Please note that our working hours are from 8 a.m. to 4:30 p.m. Monday to Friday.

If you have further questions regarding trust accounting and safety, do not hesitate to contact us.