- Become a Lawyer

- Become a Principal

- Visiting Lawyers

- Membership Services

- How to Become a Member in Alberta

- Billing Cycles, Filing Deadlines and Other Key Dates

- Status Options & Contact Information Changes

- Making a Payment to the Law Society

- Membership & Indemnity Program Renewals

- Member & Indemnity Certificates

- Indemnity & Indemnity Exemptions

- Professional Corporations (PCs)

- Limited Liability Partnerships (LLPs)

- Complaints

- Alberta Lawyers Indemnity Association (ALIA)

- Western Canada Competency Profile

- Continuing Professional Development

- Practice Advisors

- Trust Accounting & Safety

- Practice Management Consultations

- Equity Ombudsperson

- Fraud & Loss Prevention

- Approved Legal Services Providers

- Forms & Certificates

- Home

- Lawyers & Students

- Alberta Lawyers Indemnity Association (ALIA)

- Indemnity Levies

ALIA Again Reduces Annual Indemnity Levy For 2024-2025, with Lowest Misappropriation Levy Ever!

The annual levies set by ALIA and the Universal Cyber Coverage Premium payable by each Subscriber for the 2024-2025 policy year (July 1, 2024, to June 30, 2025) are as follows:

- $2,910 for Professional Liability / Negligence ($50 less than last year)

- $190 for Misappropriation ($20 less than last year)

- $265 for Universal Cyber Coverage Premium (the same as last year with increased coverage).

Invoices for these required payments, plus GST, will be available online through the Law Society of Alberta’s Lawyer Portal before May 31 and must be paid on or before June 30, 2024.

Alberta Lawyers Indemnity Association (“ALIA”) board of directors (the “Board”) has set the Professional Liability / Negligence and Misappropriation levies for the 2024-2025 policy year (July 1, 2024, to June 30, 2025) for each Alberta lawyer participating in the mandatory indemnity program (“Subscriber”) at:

- $2,910 (plus GST) for Professional Liability /Negligence (Part A)

- $190 (plus GST) for Misappropriation (Part B)

The levies are the required payments for indemnity coverage (like insurance policy premiums) that must be paid by each Subscriber for coverage each year.

In setting these levies, the Board considers:

- the detailed analysis by external actuaries;

- the claims made against Subscribers;

- the returns on ALIA’s investments, and;

- other relevant information.

When possible, without putting the indemnity program at risk of a special assessment, ALIA uses surplus capital from investment returns to subsidize the annual Professional Liability / Negligence base levy. These investment returns, combined in more recent years with the Civil Litigation Filing Levy (“CLFL”), have enabled ALIA to subsidize the base levy almost every year since 2013.

Since the 2007-2008 policy pear, ALIA has continuously used surplus capital from its investment returns to reduce the annual Professional Liability / Negligence base levy. ALIA continues to subsidize that levy this year.

For the 2024-2025 policy year, the Board has applied surplus capital of approximately $5.1 million to reduce the theoretical levy by $667 per Subscriber, resulting in a Professional Liability / Negligence base levy of $2,910 per Subscriber. (This application of surplus capital to subsidize the Professional Liability / Negligence levy is in addition to ALIA’s use of surplus capital of approximately $1 million to pay every Subscriber’s Universal Cyber Coverage Premium from January 1, 2024, through June 30, 2024.)

The Professional Liability / Negligence levy, at $2,910 per Subscriber, is $50 less than last year’s levy of $2,960. That is only 13% more than it was in 2002-2003, 22 years ago!

Also supported by actuarial analysis, the Board set the Misappropriation levy at $190 per Subscriber for the 2024-2025 policy year, the lowest since 2003 and a reduction of $20 compared to last year’s levy of $210.

The Misappropriation levy, at $190 per Subscriber, is the lowest in the history of the indemnity program, with a 71% reduction from its high of $665 per Subscriber in 2009-2010!

Key Points Regarding the 2024-2025 Universal Cyber Coverage Premium and Civil Litigation Filing Levy

Universal Cyber Coverage Premium

Commencing December 31, 2022, ALIA implemented the Universal Cyber Coverage Program for all Subscribers. The cyber coverage policy was extended from December 31, 2023, to June 30, 2024, to align the cyber coverage policy period with that of the Group Policy. This year, in addition to the Professional Liability / Negligence base levy subsidy set out above, the Board approved ALIA’s use of approximately $1 million from surplus capital to pay every Subscriber’s Universal Cyber Coverage Premium from January 1, 2024, to June 30, 2024.

The Universal Cyber Coverage Premium for the July 1, 2024, to June 30, 2025, policy period, the payment of which is the responsibility of each Subscriber, remains the same as last year ($265 per Subscriber) even though the coverage has been enhanced. Please visit ALIA’s website for more information on the Universal Cyber Coverage Program.

The invoice for the Universal Cyber Coverage Premium for 2024-2025 will be available online through the Law Society of Alberta’s Lawyer Portal before May 31 and must also be paid on or before June 30, 2024.

Civil Litigation Filing Levy (“CLFL”)

The CLFL remains the same as in previous years at $75 per filing. This per-filing levy is not included in the annual levies but instead is to be remitted by Subscribers for each qualifying filing (for example, a statement of claim) made at the Court of King’s Bench. Please visit ALIA’s website for more information on the CLFL.

ALIA’s board of directors (the “Board”) establishes the annual levy after considering relevant information, including claims history, trends, costs of the stop-loss insurance ALIA purchases, investment income, and actuarial projections. The Board also considers the recommendations of the Board’s Executive Committee, professional advisors (including its external appointed actuary, Willis Towers Watson), and ALIA’s management.

The actuary’s recommendation is based largely on their annual calculation of the costs of operating the indemnity program, including defence costs and payment of claims, which form the largest component of the levy and is why increased claims costs usually necessitate a higher levy.

In the levy-setting process, the Board first determines the “theoretical levy”, which is essentially the cost of covering claims, including defending Subscribers, repairing errors, compensating the public, and operating the indemnity program, divided by the number of Subscribers. The theoretical levy is the amount that would have to be paid by each Subscriber in the absence of any upward or downward adjustments. Those potential adjustments are changes to the theoretical levy that the Board deems appropriate for reasons that include building or reducing the indemnity program’s capital to ensure the financial health of the program, maintaining the stability of the levy over time, and guarding against the need for a special levy (like a cash call).

In deciding each year whether the indemnity program’s capital is at the right level, the Board receives the recommendation of ALIA’s management and appointed actuary. The Board uses a capital target tool specifically developed for ALIA by its actuary. If the Board determines the capital is higher than is required, it applies the excess amount to reduce the theoretical levy. However, if the capital is lower than it should be, the Board increases the levy and uses the difference to replenish the capital. The result is the actual levy that each Subscriber pays for the indemnity coverage ALIA provides.

Professional Liability / Negligence

ALIA’s investment returns play a significant role in its ability to use surplus capital to reduce the Professional Liability / Negligence base levy each Subscriber pays.

For the 2024-2025 policy year (July 1, 2024, to June 30, 2025), after considering all relevant factors, the Board accepted the recommendation of ALIA’s management, the Board’s Executive Committee, and appointed actuary and set the theoretical levy for Professional Liability / Negligence at $3,577. Absent any adjustment, that theoretical levy would have been the actual levy each Subscriber would have paid. However, the Board authorized using ALIA’s surplus capital to reduce that amount by $667 per Subscriber. This reduction resulted in a Professional Liability / Negligence base levy assessment of $2,910.

Applying surplus capital to reduce every Subscriber’s Professional Liability / Negligence is in addition to ALIA’s one-time use of surplus capital of approximately $1 million to pay every Subscriber’s Universal Cyber Coverage Premium from January 1, 2024, to June 30, 2024.

Misappropriation

The Misappropriation levy was set at $190, a 9.5% reduction from last year. This calculation is based on actuarial analysis.

Universal Cyber Coverage Premium

The Universal Cyber Coverage Premium is negotiated with the third-party insurer and is not determined by ALIA’s actuary. For details, please log in to the Law Society of Alberta’s Lawyer Portal.

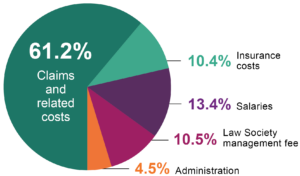

The major components of the base Professional Liability / Negligence Levy include the following:

- 61.2% Claims and related costs

- 10.4% Insurance costs

- 13.4% Salaries

- 10.5% Law Society management fee

- 4.5% Administration

ALIA continues to focus on ensuring that the levies and the Universal Cyber Coverage Premium are as low as reasonably possible for the optimal coverage. This includes but is not limited to:

- Educating Subscribers on loss prevention.

- Applying the CLFL credit based on revenue from qualifying filings.

- Taking steps to ensure compliance (filing and payment) with the requirements of the CLFL.

- ALIA’s actuary applying a risk philosophy appropriate for a mandatory non-profit program.

- ALIA’s continued focus on enhancing its operating efficiencies.

- Projecting an increase in the number of Subscribers.

Payment of the annual levy is due by June 30, 2024.

Invoices will be made available online through the Law Society of Alberta’s Lawyer Portal before May 31.

The amounts of the invoices for those without individual surcharges will be:

- $2,910 per Subscriber for Professional Liability / Negligence (Part A)

- $190 per Subscriber for Misappropriation (Part B)

- $265 per Subscriber for Universal Cyber Coverage Premium

- Plus GST on each

Total: $3,533.25 including GST.

Levy FAQs

The 2024-2025 base levy for Professional Liability / Negligence is $2,910.

Subscribers also pay $190 for Misappropriation coverage and $265 for Universal Cyber Coverage.

The total for these levies and Universal Cyber Coverage is $3,365 plus GST, or $3,533.25 including GST.

You can expect to receive communications regarding the invoice for your levies and Universal Cyber Coverage Premium (and any applicable surcharge based on your individual claims history) before May 31.

Payment of the levies and Universal Cyber Coverage Premium is due by June 30, 2024. Payments can be made in a single payment or by two instalments. Invoices will be made available online through the Law Society of Alberta’s Lawyer Portal.

For information on how to make a payment to ALIA, view Making A Payment to ALIA.

Payment of the levies and Universal Cyber Coverage Premium is to Alberta Lawyers Indemnity Association even though it is made on the Law Society of Alberta’s Lawyer Portal.

Payments can be made electronically. Please visit Making a Payment to ALIA for payment options and instructions.

Please be advised that payments by cheque, e-transfer/email transfer, direct deposit, and bank drafts cannot be accepted.

In short, it does not. In five of the previous six years, ALIA has reduced the combined base levy (Professional Liability / Negligence and Misappropriation). Those reductions were made possible by active cost reductions by ALIA – including restructuring the indemnity program – and higher-than-expected returns on investments, and not by any substantial reductions in the number or severity of claims against Subscribers.

The theoretical levy for Professional Liability / Negligence is lower than last year.

2024-2025 Professional Liability / Negligence Levy calculation:

$3,577 – theoretical levy for Professional Liability / Negligence is lower than last year due to a minor decrease in the number of expected paid claims and the resolution of older claims for less than reserves.

$667 – amount per Subscriber subsidized by ALIA’s capital

= $2,910 base levy for Subscribers for Professional Liability / Negligence.

Two years ago, the Misappropriation levy was reduced from $388 to $210. It was reduced again to $190 for the upcoming 2024-2025 policy year.

The launch of the Universal Cyber Coverage Program on December 31, 2022, was at a cost of $265 per Subscriber. This coverage was introduced after identifying trends in cyber crime targeting law firms with the potential impact being too large a risk to ignore, as well as feedback from Subscribers indicating a majority are in favour of adding cyber coverage. Every other province except Quebec has implemented some form of mandatory cyber coverage.

The indemnity program runs on a non-profit basis. Therefore, there is a direct link between the amount the program pays out to defend Subscribers and satisfy claims against them, and the total amount of the levy assessed on Subscribers.

Where possible, ALIA uses surplus capital to reduce the Professional Liability / Negligence levy. However, as ALIA’s capital fluctuates over time, capital reductions may not always be possible. Subscribers must remain vigilant in claims prevention, as future levies can be reduced by lowering the frequency and severity of claims made against Subscribers.

The Program runs on a non-profit basis. Therefore, there is a direct link between the amount the indemnity program pays out to defend Subscribers and satisfy claims against them and the total amount of the Professional Liability / Negligence levy assessed on Subscribers.

Where possible, ALIA uses surplus capital to reduce the theoretical levy. However, as ALIA’s capital fluctuates over time and capital reductions may not always be possible, Subscribers must remain vigilant in claims prevention, as future levies can be reduced by lowering the frequency and severity of claims made against Subscribers.

No. ALIA’s investment returns play a significant role in its ability to use surplus capital to reduce the levy paid by Subscribers. Higher returns this year enabled ALIA to apply surplus capital to reduce the Professional Liability / Negligence Levy by $667 per Subscriber, as well as to apply a $1 million subsidy to pay every Subscriber’s Universal Cyber Coverage Premium from January 1, 2024, to June 30, 2024.

Compared with the previous year, a minor decrease in the number of paid Professional Liability / Negligence claims is expected; however, the cost to settle the paid claims is predicted to slightly increase.

ALIA leadership deems it essential to subsidize as much as possible for Subscribers while still maintaining adequate reserves to cover the costs of operating the indemnity program, including defence costs and payment of claims.

ALIA continues to focus on finding ways to reduce the levy, which include but are not limited to:

- Educating Subscribers on loss prevention.

- Applying the CLFL credit based on revenue from qualifying filings.

- Taking steps to ensure compliance (filing and payment) with the requirements of the CLFL.

- ALIA’s actuary applying a risk philosophy appropriate for a mandatory non-profit program.

- ALIA’s continued focus on enhancing its operating efficiencies.

- Projecting an increase in the number of Subscribers.

ALIA and the Law Society are working to avoid or reduce claims in various ways, including the following:

- providing ALIAlerts to warn Subscribers about current fraud schemes that are targeting lawyers and their firms;

- conducting educational outreach sessions to Subscribers on claims and loss prevention;

- auditing new and legacy law firms to ensure responsible practices are in place;

- enhancing our electronic trust transaction review capabilities and ongoing risk assessments to identify and address unacceptable practices;

- providing information and resources, such as ALIAdvisory education articles; and

- providing significant funding to the Alberta Lawyers’ Assistance Society (Assist) program to make additional support resources available to Alberta lawyers and families.

Looking forward, ALIA continues to investigate opportunities to reduce the levies by enhancing loss prevention activities and assessing options for future Program funding.

Most types of negligence claims are avoidable, such as claims resulting from missed limitation dates and dismissal for delay. Surprisingly, this is the largest area of losses for the indemnity program and, accordingly, the largest contributing factor to the Professional Liability / Negligence levy. There is an opportunity for Subscribers to lower this levy by reducing costs for all types of claims over the coming years.

As the frequency and severity of claims directly affect the Professional Liability / Negligence levy, ALIA continues to stress the importance of loss prevention and asks Subscribers to avoid or minimize claims. ALIA’s claims funding model ensures that money saved on claims will result in lower levies in future years.

Yes. Although participation in the indemnity program is mandatory for Alberta lawyers in private practice, several categories of lawyers are exempt from the program and the levy assessments.

Alberta lawyers employed by a government, corporate, or similar organization (other than a professional corporation), or in another similar employment or independent contractor relationship, as exempted by the Law Society’s Executive Director or ALIA’s President and Chief Executive Officer, are not assessed the levies. These lawyers are not covered by the indemnity program and, accordingly, they, their employers, or their private insurers (if they purchased insurance) would be responsible for any losses.

Additionally, some Alberta lawyers are indemnified at no charge for pro bono services through approved organizations as set out in Rule 148 of The Rules of the Law Society of Alberta. The Rules of the Law Society of Alberta also set out several other exemptions.

Finally, for a time, lawyers who had practiced for over 50 years were exempted from paying the levy as long as they remained claims free. Although this exemption has been removed, those lawyers who received it at the time have been grandfathered.

ALIA does not offer pro-rated refunds. Instead, ALIA allows lawyers to pay in two installments. For example, if a lawyer leaves private practice before the second installment is due, then the second installment is not payable, and the lawyer only paid 50 per cent of the levy.

All Subscribers historically shared the burden of incurred losses equally by paying the same levy. However, some Subscribers may be subject to special assessments (called “surcharges”) in addition to the base Professional Liability / Negligence Levy due to their individual claims history. Surcharges are made pursuant to the Rules of the Law Society of Alberta and are set at rates approved by the Board. More information on the Enhanced Surcharge Protocol can be found on the Enhanced Surcharge Protocol FAQs.

The CLFL also came into effect starting July 1, 2021, for an ongoing pilot project. The terms of the CLFL, including the obligation to self-report and pay the CLFL commencing October 31, 2021, are contained in the Transaction and Filing Levy Schedule. For more information on the CLFL, view the Civil Litigation Filing Levy Pilot.

Yes. Although ALIA does not sell excess coverage (over the mandatory $1 million per occurrence), it recommends that all Subscribers investigate purchasing optional excess coverage for additional protection and periodically review their excess coverage to ensure it is proportionate with the risk and value of transactions undertaken by the Subscriber and their law firm.

Excess coverage may be purchased from the Canadian Lawyers Insurance Association (“CLIA”) or through various brokers such as Aon and Marsh.

The Group Policy, the indemnity contract that sets out the coverage provided by ALIA, is posted on ALIA’s website. To assist Subscribers, ALIA has updated its website to include responses to frequently asked general policy questions, such as basic coverage information, under Group Policy FAQs.

If you have questions or comments regarding anything related to ALIA, please contact ALIA.

Any summary of the Group Policy contained above is provided for general information purposes only and not as legal advice and is qualified in its entirety to the terms and conditions of the Group Policy. Subscribers should always review the Group Policy to confirm their obligations in any circumstance.

ALIA does not provide legal advice. ALIAdvisory notices, ALIAlerts and the content on ALIA’s website, notices, blogs, correspondence, and any other communications are provided for general information purposes only and do not constitute legal or other professional advice or an opinion of any kind. This information is not a replacement for specific legal advice and does not create a solicitor-client relationship.

ALIA may provide links to third-party websites. Links are provided for convenience only; ALIA does not vet or endorse the information contained in linked websites or guarantee its accuracy, timeliness, or fitness for a particular purpose.