- Become a Lawyer

- Become a Principal

- Visiting Lawyers

- Membership Services

- How to Become a Member in Alberta

- Billing Cycles, Filing Deadlines and Other Key Dates

- Status Options & Contact Information Changes

- Making a Payment to the Law Society

- Membership & Indemnity Program Renewals

- Member & Indemnity Certificates

- Indemnity & Indemnity Exemptions

- Professional Corporations (PCs)

- Limited Liability Partnerships (LLPs)

- Complaints

- Alberta Lawyers Indemnity Association (ALIA)

- Western Canada Competency Profile

- Continuing Professional Development

- Practice Advisors

- Trust Accounting & Safety

- Practice Management Consultations

- Equity Ombudsperson

- Fraud & Loss Prevention

- Approved Legal Services Providers

- Forms & Certificates

- Home

- Lawyers & Students

- Alberta Lawyers Indemnity Association (ALIA)

- Universal Cyber Coverage Program

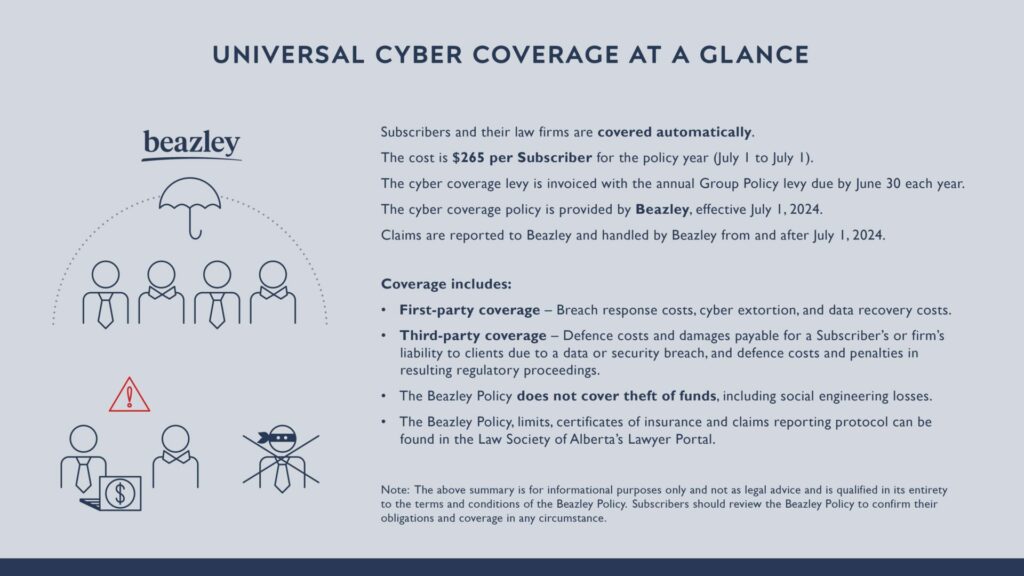

Commencing December 31, 2022, Alberta Lawyers Indemnity Association (“ALIA”) implemented universal cyber coverage for all lawyers who participate in ALIA’s mandatory indemnity program (“Subscribers”). The cyber coverage policy was extended from December 31, 2023, to July 1, 2024, to essentially align the cyber coverage policy period with that of the Group Policy. ALIA’s expectation is that cyber coverage will continue each year indefinitely, with its annual premium payments aligned with the Group Policy levies (i.e., due on or before June 30 for the 12-month policy period commencing July 1 each year).

The cyber coverage program—provided by a global insurer and administered by ALIA—is designed to protect Subscribers, their law firms and, by extension, their clients by giving Subscribers and their law firms quick access to critical resources needed to respond to cyberattacks. It also covers claims for data and security breaches and regulatory proceedings brought against Subscribers and their law firms.

Subscribers and their law firms do not need to submit individual insurance applications or go through an (often onerous) application process to receive this coverage. The coverage is provided seamlessly and automatically to all Subscribers and their law firms. The annual Universal Cyber Coverage Premium is included in the annual levy invoice, and the premium amount is announced in the annual ALIAdvisory levy announcement.

In initially approving the Universal Cyber Coverage Program, the Law Society of Alberta Benchers and ALIA’s Board recognized the importance of universal cyber coverage to protect Subscribers, their law firms and, by extension, their clients. Lawyers are attractive targets to cybercriminals due to the sensitive, confidential client information stored in the computer systems they use. Cybercriminals seek to extort or steal this information through ransomware and other malware. Cyberattacks can cripple computer systems and block access to files and information, interrupting professional services and exposing client information to criminals. Attempted attacks–some of which are successful–against Subscribers and their law firms are reported to ALIA regularly, but these types of claims are not covered by the ALIA Group Policy. Every province except Quebec has implemented some form of mandatory cyber coverage.

Universal cyber coverage ensures that all Subscribers have access to the critical breach response resources required to manage a cyberattack. Without insurance, expert resources needed to manage a cyber breach can be difficult to locate in an emergency. The cyber program provides all Subscribers with 24/7 access to cyber expertise in the event of a security breach to help restore professional services and reduce exposure to claims for client losses.

Universal cyber coverage also provides liability coverage for claims arising from cyber incidents, subject to the limits set out in each Subscriber’s Cyber Coverage Certificate, which is available in the Law Society of Alberta’s Lawyer Portal. The coverage includes first-party coverage for breach response costs, data recovery costs, and cyber extortion, and third-party coverage for claims against Subscribers or their law firms for data or security breach.

After many months of research, ALIA, assisted by its broker, Aon Reed Stenhouse Inc. (“Aon”), selected Beazley Canada Limited (“Beazley”) to provide the Universal Cyber Coverage Program (the “Beazley Policy”) effective July 1, 2024. Although there were no concerns with the previous insurer, Zurich Insurance Company Ltd. (“Zurich”), ALIA works to ensure that its Subscribers continue to receive the best value for their premiums/levies, and the increased coverage provided by Beazley merited the switch in insurers.

Beazley is one of the top insurers in Canada for cyber risk and currently underwrites cyber programs and provides 24/7 claims service. In addition, Beazley agreed to accept all Subscribers into the program without requiring an onerous application process, meaning all Subscribers and their law firms continue to have coverage.

Previous Cyber Coverage Certificates (i.e., certificates for the period December 31, 2022, to 12:01 a.m. on July 1, 2024) refer to the Zurich cyber policy (the “Zurich Policy”). Claims made up to 12:01 a.m. on July 1, 2024, should be reported under the Zurich Policy. Notices of claims must be provided as soon as possible and in no event later than 60 days after the end of the policy period. Claims of which Subscribers become aware during the period December 31, 2022, to 12:01 a.m. on July 1, 2024, and are not reported within this timeframe will not be covered by the Zurich Policy or the Beazley Policy. Cyber Coverage Certificates for the Zurich Policy are available in the Law Society of Alberta’s Lawyer Portal. For further information on the Zurich Policy, including a copy of the policy and the claims reporting protocol, please contact ALIAcyber@aon.ca.

If Subscribers are uncertain as to which policy to report matters under, they can reach out to ALIAcyber@aon.ca with a request for additional support.

ALIA intends to continue the cyber program indefinitely. That said, pricing and availability of future policies will depend on the program’s loss history and the cyber coverage market. ALIA endeavours to deliver a high-quality indemnity program in which Subscribers have access to appropriate coverage at a reasonable price while continuing to keep the levy as low as reasonably possible. While the cyber coverage modestly increases the total amount payable by each Subscriber annually, it ensures that all Subscribers have cyber coverage and access to critical resources needed to manage a cyber breach.

Subscribers play an essential role in the continuing success of the Universal Cyber Coverage Program by ensuring they practice good “cyber hygiene” to reduce or eliminate cyberattacks. Practicing cyber hygiene includes implementing network security controls to improve online security to mitigate cyber breaches and conducting cyber security awareness training.

The cyber coverage program includes access to regular cyber security seminars that ALIA will host with experts from Aon and Beazley. Topics will include education on best practices to protect Subscribers and their law firms from cyberattacks.

All Subscribers should read the Cyber Coverage FAQs to understand what the Universal Cyber Coverage Program does and does not include. Subscribers should also review the Beazley Policy coverage and limits, which information is available to Subscribers through the Law Society of Alberta’s Lawyer Portal. Please note that some coverages set out in the text of the Beazley Policy are inapplicable. Subscribers should refer to their Cyber Coverage Certificate available in the Law Society of Alberta’s Lawyer Portal for a listing of the coverages provided under the Beazley Policy.