Trust Account Fraud Update

Law firms have been a rising target for fraudsters over recent years, with reports of fraud and claim amounts increasing year-over-year. Lawyers should be aware of common types of fraudulent activity and pay close attention to their records, communication platforms and system security. Although fraud cannot be fully prevented, certain steps can be taken to minimize risk and loss.

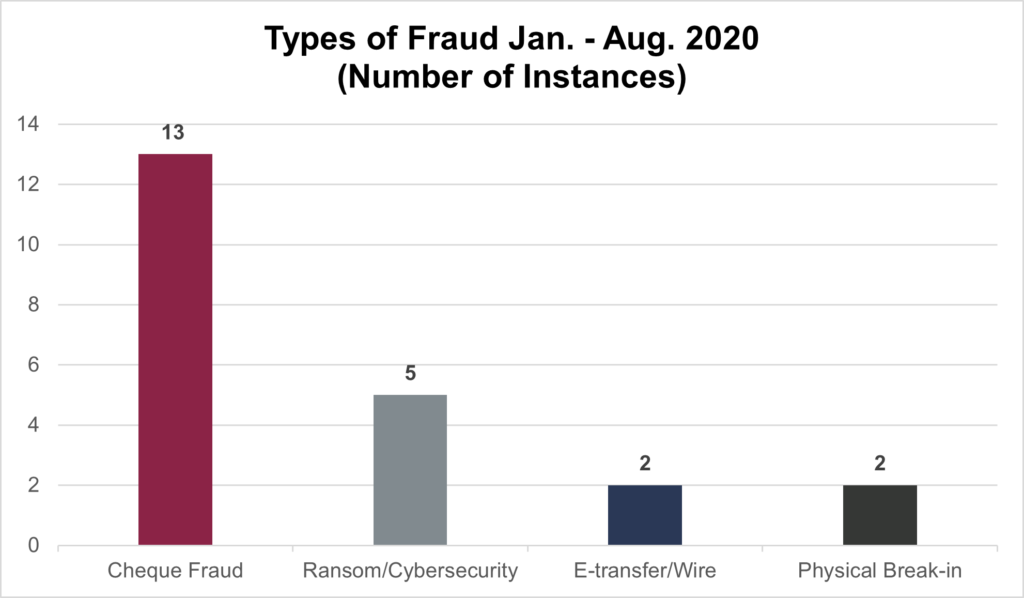

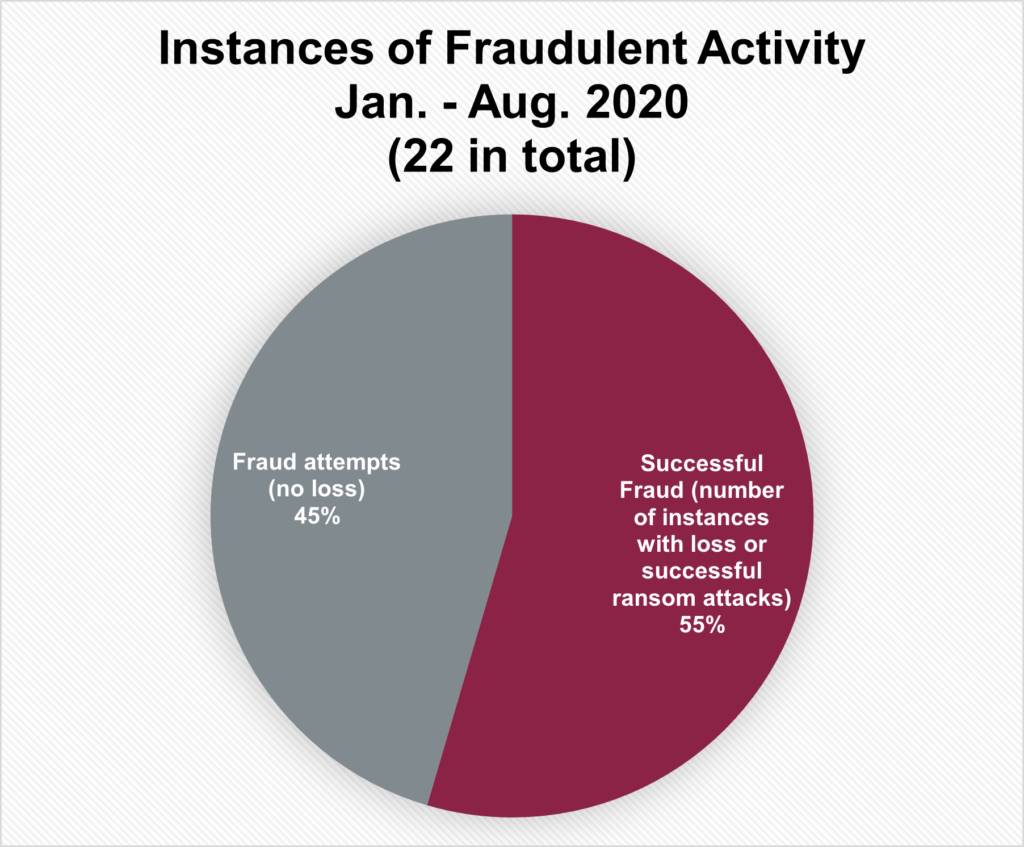

The charts below represent a summary of fraudulent activity reported to the Law Society’s Trust Safety department this year, with a total loss of $94,000.

Although cheque fraud remains the most common type, fraudsters are becoming increasingly sophisticated and convincing and are resorting to well-planned and executed ransom and cybersecurity attacks.

Fraudulent cheques are typically categorized by forged signatures that look undistinguishable from those of the lawyers within the firm.

Ransom/cybersecurity attacks involve hacking into the firm’s accounting systems and demanding a ransom to recover their data. Even if the firm pays the ransom or is able to get their data back, the information can be corrupted.

In instances of e-transfer/wire fraud, the fraudsters masquerade as a law firm employees or clients to obtain funds.

Measures to minimize risk – Your ounce of prevention

Frequent monitoring of your trust and general accounts is recommended to ensure no unsolicited transactions have occurred, or if they have, they are caught and remedied quickly. Additionally, it is crucial to ensure your computer systems are secure, updated and backed up regularly.

Be wary of emails and phone calls from unknown individuals and entities and always verify the email address you receive correspondence from.

Finally, consider whether you have or should get insurance that would indemnify you for a fraud loss.

If you have any questions, comments or concerns, contact the Law Society’s Trust Safety department via email or at 403.228.5632.