Fraud Prevention Month: Trust Theft and Indemnity Coverage

March is Fraud Prevention Month, and we want to raise awareness about the risk of fraud in legal practice because when lawyers and firms become victims of fraud or theft, it affects the reputation of the legal profession and may impact their ability to attract and retain clients.

We want to remind lawyers that there is no coverage for theft by law firm staff under the Alberta Lawyers Indemnity Association’s (ALIA) Group Policy.

Lawyers and partners are often busy with their legal practice and may be less focused on running the business. This can lead to duties, including trust accounting, being delegated to non-lawyer staff and often to one person with little or no oversight from a lawyer. This lack of oversight is frequently a product of the trust lawyers have in the staff members. Many of the thefts are not sophisticated and could have been prevented by relatively simple internal controls.

Responsible Lawyers (RLs) can delegate certain tasks to firm employees, but any delegation must be made with an appropriate degree of oversight. It is the responsibility of the RL to safeguard client funds, not the bookkeeper, paralegal, office manager or accountant.

The RL is responsible for staff misconduct including theft from trust accounts. You may face civil liability for the theft of trust funds if you are unable to make restitution. Since theft by staff is not covered under ALIA’s Group Policy, we recommend obtaining employee theft coverage as described in the recent ALIAdvisory.

The Law Society is aware that law firms and lawyers have experienced employee thefts, and is available to provide ongoing practice management supports, including advice from Practice Advisors.

Cheque Fraud and Prevention

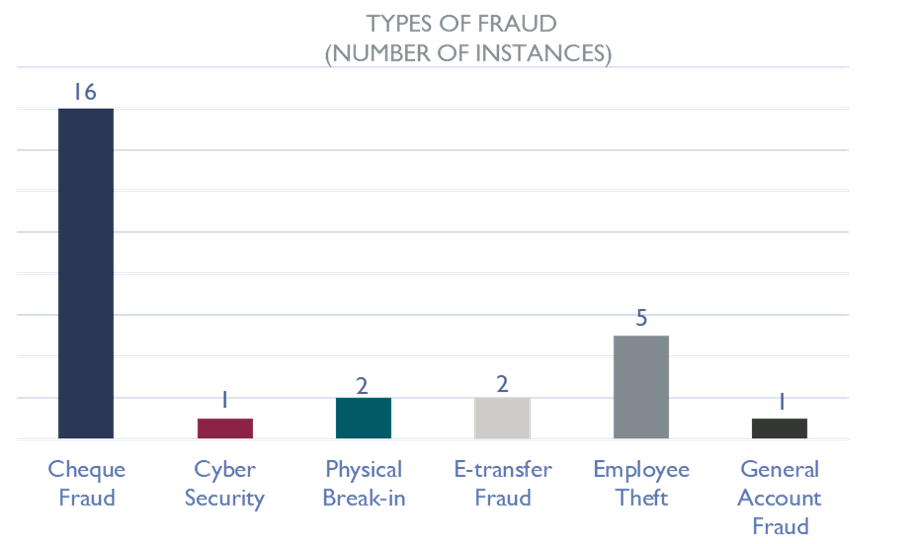

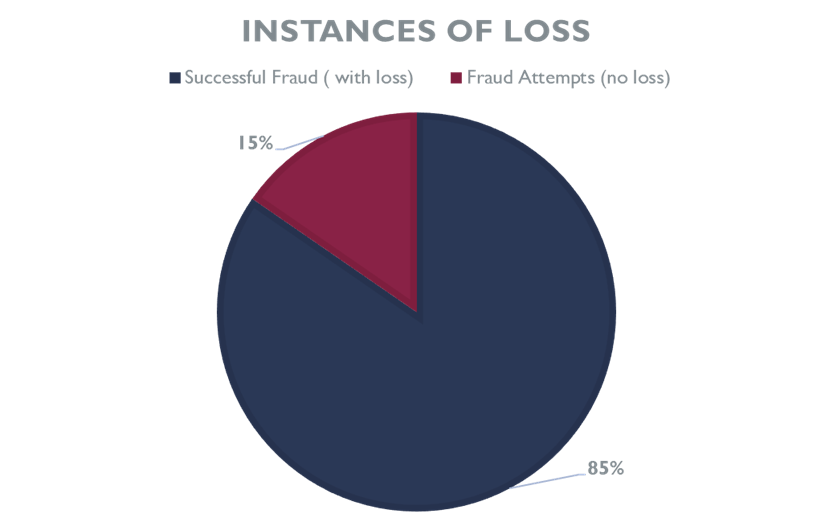

The charts below represent a summary of fraudulent activity reported to the Trust Safety Department in 2023. The total amount of reported fraud loss was over $1 million.

Cheque fraud remains the most common type of fraud. In cheque frauds, fraudsters either steal physical cheques and alter them, or forge signatures that are indistinguishable from those of the lawyers within the firm.

Fraud affects all lawyers and is an evolving risk that we must all pay attention to. Fraudsters take advantage of weakened controls, new processes, and failure to exercise appropriate oversight. You should assume that anyone can and will commit fraud under the right circumstances.

Talk to your colleagues and staff about fraud. The more comfortable everyone is with the concept, the more likely they will be able to quickly identify unusual circumstances, which may indicate fraud. When lawyers and firms become victims of fraud or theft, it affects the reputation of the legal profession and may impact their ability to attract and retain clients.

For more information on theft, employee theft and fraud, view the Law Society website.